Even though you may have substantial medical insurance for your own family, the policy’s provisions won’t meet the requirements set with the aid of the college your toddler attends. You’ll be forced to shop for new coverage the college sells or sponsors in that method. At some colleges, the coverage price is over $five 000 for the 2019–2020 educational year (see the desk underneath). The way to avoid this charge is to get a waiver from your college by proving you have a fitness insurance plan akin to the only one it sells. The system to do this for the academic year frequently occurs in July and August or the month before the lessons bills pop out.

There is a superb motive for schools’ mandatory medical health insurance and its stringent necessities. Colleges are understandably worried that students should face debt from clinical costs that dwarf even their pupil-loan debt. And also, like the price of mandatory pupil medical health insurance is often a vast wonder for many households, in a few conditions, the university’s coverage policy can truely present both financial savings and a higher plan. However, faculties need to improve their grades by making students and parents aware of this obligatory additional fee.

My Surprise

About a month before receiving the bill for my daughter’s first yr, I obtained a shaped email from the college pointing out that she becomes routinely enrolled in its student fitness-coverage plan until I completed an internet utility to get hold of a waiver. The price of the policy was around $1,500. This price changed into now not indexed inside the table the college published on its internet site and not part of the fee facts that appear in various websites and books as a university attendance price.

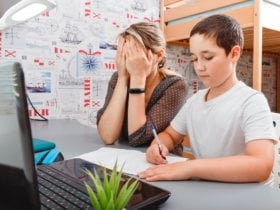

I’m a monetary educator focused on fairness repayment (inventory options, confined stock, ESPPs) via the internet site myStockOptions.Com, which has a section on financial making plans for university funding. Thus I’m financially conscious and have carefully stored for my children’s college education, ordinarily in 529 Plans. This new and colossal price was taken aback and baffled me. I run a small business and already pay about $12,000 per 12 months for a family plan. I no longer see the need to pay for every other fitness plan. While I changed into capable of gaining the waiver and choosing out of this additional cost for my daughter’s four years of college, for my son, now at another college, it’s more challenging and complicated.