In a new record, the U.S. Financial Literacy and Education Commission “recommends that establishments of higher training require obligatory economic literacy guides.” It is set to time. The common student loan debt inside the U.S. Stands at $33,310. In reality, basic student mortgage debt is about $1.5 trillion; this means that pupil debt has become the second one-biggest debt market after mortgages. There are apparent worries about this mounting student mortgage debt. When reviewing records from the 2015 National Financial Capability Study, we discovered that 45% of individuals aged 18 to 34 had a student loan.

Thus, almost 1/2 of younger Americans start their working lifestyles in heavy debt. But there are many warning signs that debtors did not completely understand what they have been taking on after receiving their loans. That point the NFCS records showed that, at that point, 54% of student mortgage holders did not try to figure out how an awful lot their future month-to-month bills would be earlier than taking up their loans. As similar evidence that pupil loan selections are not nicely notion out, a staggering 53% stated that they could make an exchange if they might go through the process of eliminating loans once more.

The state of affairs appears dire because a high-quality deal of pupil mortgage debt is taken on by using human beings who have little know-how of what they may be signing up for in the first place. Many of these students sense uneasy and unsure, with 48% of student mortgage holders expressing subject approximately their capability to repay their student debt. Sadly, the state of affairs isn’t always enhancing. The 2018 NFCS information launched the remaining week shows that most scholar debt holders no longer try to estimate their monthly bills in advance. Also, approximately 1/2 of student debt holders are involved in being capable of repaying their loans.

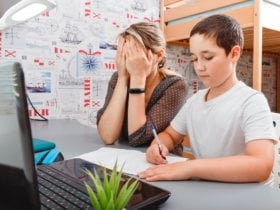

And pupil debt holders have struggled with payments. The 2018 NFCS record shows that 42% have been late with an amount at least once in the beyond yr, up slightly from 37% in 2015. This debt crisis is manifestly weighing heavy on scholars, inflicting financial tension. As many as 63% of younger humans aged 18 to 34 inside the 2018 NFCS stated, “Considering my non-public price range could make me experience hectic.” The absence of monetary literacy can lead to owing large quantities of debt and making bad financial decisions. Therefore, it’s a step within the proper route that many universities and colleges have started coaching non-public finance publications. It is a critical and welcome alternative if we must ensure that younger humans have the basic skills and know-how to manipulate their scholar loans.